What Is OCR API and How Does It Simplify Invoice Management?

In today’s competitive business world, companies constantly look for ways to enhance productivity and reduce costs. Thanks to technological advancements, businesses are able to achieve this by automating and streamlining their operations. One such technology is OCR or optical character recognition. While OCR has many use cases for businesses, one area where it has proven to be highly valuable is in automated invoice processing. Today, specialized OCR solutions are available for invoice processing, such as an invoice OCR API.

These APIs leverage advanced machine learning algorithms to extract data from invoices automatically. Invoice processing automation also involves automatic data validation and verification. Finally, the data is delivered to the organization’s accounting or ERP software for approval and payment processing.

In this article, we’ll discuss the role of an invoice OCR API in automating invoice processing and its advantages.

Key Takeaways

- OCR Saves Time and Money: By automating invoice data extraction, you dramatically cut processing costs and labor expenses.

- Increased Accuracy: OCR tools leverage machine learning for precise extraction, reducing the risk of human errors.

- Streamlined Workflows: You can integrate OCR with your accounting system, ensuring automated validation, approval, and payment steps.

- Fraud Detection: Automated data comparison helps you quickly spot fake or manipulated invoices.

- Scalability: As your invoice volume grows, OCR technology seamlessly scales without requiring a large increase in manual labor.

The challenges of traditional invoice processing

Before we delve deeper into how an OCR API simplifies invoice management, let’s look at the conventional approach to invoice processing:

- An employee manually extracts data (vendor name, invoice number, etc.) from invoices.

- The next step involves manual data entry into a computer.

- Another staff member validates and verifies the extracted data.

- The data must be matched against purchase orders or other documents.

- Finally, the data is sent for approval and payment processing.

This manual, paper-based approach suffers from numerous pitfalls:

- Time-Consuming: Manual data extraction and entry often lead to delayed payments and bottlenecks.

- Error-Prone: Typos, miscalculations, and overlooked details can lead to financial losses.

- Resource-Heavy: You need multiple staff members, which results in higher operational costs.

- Limited Visibility: Paper invoices make real-time tracking difficult.

By introducing invoice OCR processing, you address these pain points directly.

Why Invoice OCR Processing Is Key for Reducing Manual Error

Manual invoice processing is notorious for human errors—typos, incorrect amounts, or mismatched vendor details. These errors stall payment approvals, disrupt cash flow, and erode trust. Invoice OCR processing uses advanced machine learning algorithms to automatically and accurately read and record invoice data. Because the technology consistently captures data at high accuracy rates, you significantly reduce the risk of manual errors. Less time spent on error correction frees you up to focus on tasks that actually grow your business, such as financial planning and vendor relationship management.

What is an invoice OCR API?

OCR is an advanced technology that automatically extracts text from printed and digital documents. Advanced OCR solutions can even extract data from handwritten documents accurately. OCR leverages machine learning and neural networks to extract and transform data into machine-readable text.

An invoice OCR API is a specialized OCR solution for extracting data from invoices and financial documents. Such APIs can accurately extract specific data from invoices, such as:

- Vendor name

- Total amount

- Invoice number

- Dates

- Line items

Moreover, advanced invoice OCR technology can efficiently recognize various invoice layouts and formats. Hence, they can extract data from structured and unstructured invoices. This feature is essential as different vendors/industries have different invoice layouts/formats. Another key feature of an invoice optical character recognition API is that we can integrate them with other software systems seamlessly. For instance, an invoice OCR API can integrate with accounting or ERP software to automate the entire process, including payment processing.

Top Benefits of Using OCR for Invoice Management

If you’re evaluating OCR invoice automation, consider some of its biggest advantages:

- Improved Accuracy

OCR technology extracts data with high precision, drastically minimizing human-induced mistakes. This accuracy extends to both printed and handwritten documents. - Cost Savings

By automating data extraction and validation, you eliminate many manual steps, reducing the labor costs associated with invoice processing. - Time Savings

Automated invoice processing accelerates everything from data entry to approval and payment cycles, helping you manage high-volume invoices rapidly. - Increased Efficiency

With invoice OCR, you can handle a larger number of invoices with fewer staff members. This means your team can dedicate more energy to strategic tasks, rather than mundane data entry. - Fraud Detection

By validating extracted data against purchase orders and contracts, OCR solutions help you detect discrepancies and potential fraud faster. - Better Visibility

You gain a real-time view of invoice status—whether it’s pending approval or processing payments. This transparency streamlines communication and decision-making.

How does automated invoice processing work?

Here’s how invoice processing automation can work for you:

Invoice Scanning and Data Extraction

The first step for you is scanning your printed and digital invoices and uploading them to an automated processing system. With an integrated invoice OCR API, you can extract critical data—such as invoice numbers, vendor details, and total amounts—automatically.

Validating Data

Once the system extracts the data, it validates the information against your company’s pre-defined rules. This ensures the extracted details are correct and accurate, saving you time and reducing errors.

Data Verification and Exception Handling

Next, your data is verified against relevant purchase orders, contracts, or other documents using integrated tools. This eliminates the need for manual cross-referencing. If any discrepancies or missing data are found, the system flags and reports the issues, so you can address them quickly and efficiently.

Integration with Accounting and ERP Software

By integrating the invoice OCR API with your accounting or ERP software, you can implement an automatic approval workflow. This lets you process invoices, send them for automatic approval, and even initiate payment processing—all without manual intervention.

Advantages of Automating Invoice Processing with an Invoice OCR API

Improved Accuracy

With OCR technology, you can automate invoice processing and accounts payable tasks with ease. Specialized invoice OCR solutions extract data from invoices with exceptional accuracy, regardless of the format or layout. This helps you eliminate human errors associated with manual data entry.

Cost Savings

By automating invoice processing, you can save on the costs tied to manual labor for data extraction, entry, and processing. Plus, fewer errors mean fewer financial losses for your business.

Time Savings

By automating your invoice processing, you can speed up the entire workflow—from data entry to approval and payment processing. This saves you valuable time and streamlines your operations effortlessly.

Increased Efficiency

With OCR automating data extraction from your invoices, you no longer need to rely on manual data entry. This means you can process invoices much faster and handle high volumes with better efficiency.

Fraud Detection

When you use automated invoice processing, the system extracts, validates, and verifies your data. This ensures the information is accurate and correct, making it easier for you to detect fraudulent activities, such as invoice manipulation.

Better Visibility

Automation allows you to track the status of your invoices in real-time. You can monitor their progress, identify bottlenecks, and make improvements to your workflow more effectively.

Also Read: Real-world use cases of an OCR API.

Example of an Invoice Processing OCR Tool: Filestack OCR

Filestack provides you with a comprehensive suite of APIs and tools for:

- File uploads

- Online file delivery

- Transformation

With Filestack’s advanced OCR functionality, included in the Processing API, you can perform robust digital image analysis. The OCR API detects features character-by-character, enhancing the accuracy of text detection. You can rely on it to identify various invoice layouts and formats precisely.

Moreover, you can use Filestack’s OCR API to extract data from other types of documents, such as:

- Business cards

- Credit cards

- Driver’s licenses

- ID cards

- Financial documents

- Tax documents

- Passports, and more.

Advanced document detection and pre-processing solutions

Filestack OCR also leverages highly advanced document detection and pre-processing solutions for improved accuracy. The document detection system uses sophisticated supervised and unsupervised machine learning algorithms. This allows the OCR engine to efficiently detect complex documents, such as rotated, folded, or wrinkled documents. Hence, the OCR engine extracts data with higher accuracy.

The figure below depicts the complete Filestack OCR data extraction process:

Image enhancements

You can also leverage the Filestack Processing API to transform scanned images/documents and improve their quality. This allows for enhanced OCR data extraction accuracy. Here are some ways you can transform your scanned images:

- Upscale images

- Crop images

- Resize images to standard size

- Remove noise from images

- Convert the image file to a unified format

- Compress images

- Apply various image enhancements and filters

Implementing invoice OCR APIs

A good OCR API like Filestack OCR integrates seamlessly with existing workflows and systems. Here are common steps for implementing Filestack invoice OCR API:

- Sign up to create a Filestack account

- Obtain your unique API key from your Filestack dashboard

- Implement Filestack file upload using Filestack JavaScript SDK.

- Upload your file/image/invoice with Filestack.

- Generate “Security Policy” and “Signature.” In Filestack, these two parameters are implemented for security purposes and are necessary to perform OCR. A security policy is essentially a set of rules defining how a file can be processed or accessed. Signature is associated with the Policy, and it ensures that the API request complies with the policy. To generate Policy and Signature, go to your Filestack dashboard and then go to the “Policy and signature” tab.

- Use the following URL to perform OCR with Filestack:

https://cdn.filestackcontent.com/security=p:<POLICY>,s:<SIGNATURE>/ocr/<HANDLE>

*Replace Policy and Signurate with your generated POLICY and SIGNATURE. Also, replace HANDLE with the file handle returned by Filestack when your file is uploaded.

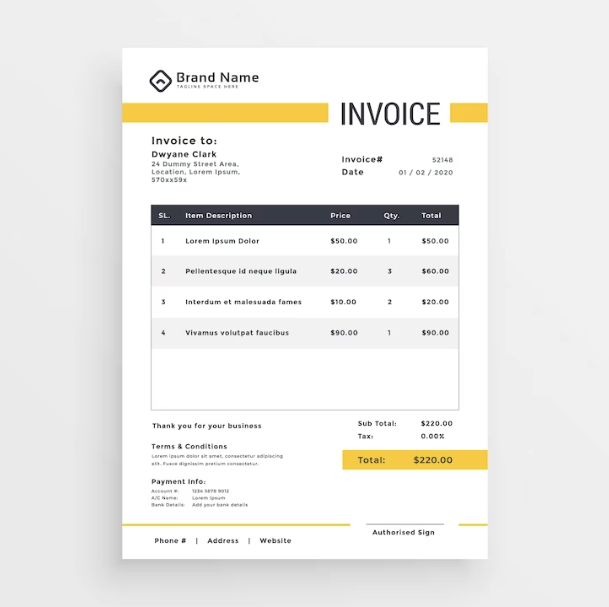

Implementing Filestack OCR

The steps below show how to test Filestack OCR:

We’ll perform OCR on the following image:

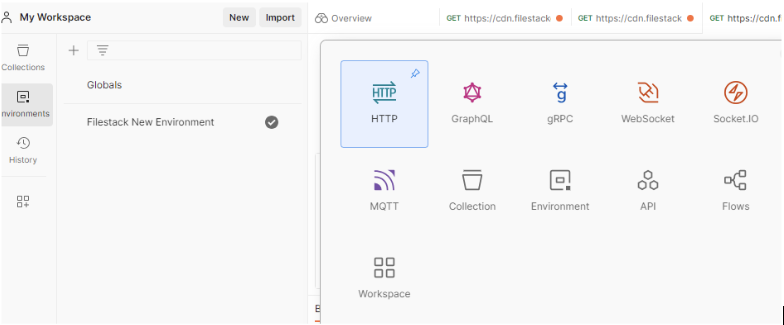

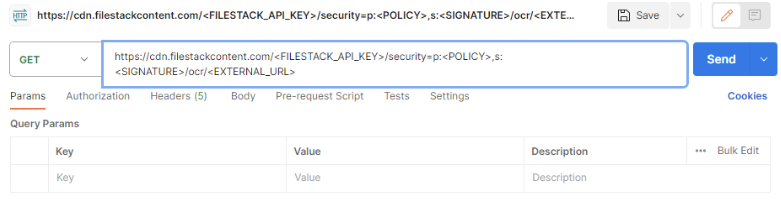

1) Go to Postman and create a new request

2) Enter the following URL in Postman’s GET method

https://cdn.filestackcontent.com/<FILESTACK_API_KEY>/security=p:<POLICY>,s:<SIGNATURE>/ocr/<EXTERNAL_URL>

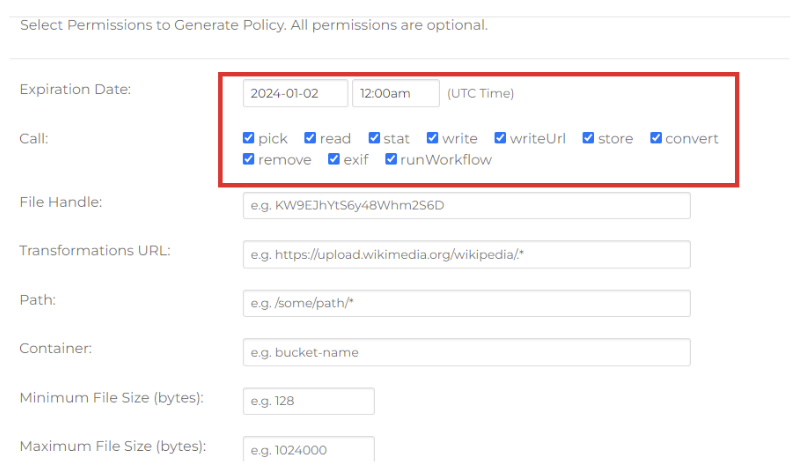

3) Go to your Filestack dashboard, then go to the security tab and click “Policy & Signature.”

4) In the “Policy & Signature” section, add an expiration date and check the following boxes:

5) You’ll now get a Policy and Signature that you’ll need to perform OCR.

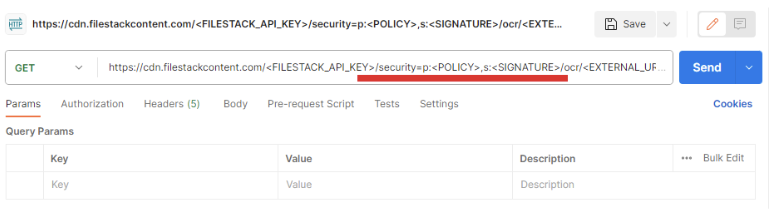

6) Copy and paste the Policy and Signature in Postman

Remember to replace <FILESTACK_API_KEY> with your API key available in your Filestack dashboard. Also, replace <EXTERNAL_URL> with the actual URL of the image/invoice. If you’re using Filestack file uploader to upload your invoice, replace the <EXTERNAL_URL> with the <HANDLE> returned by Filestack. Finally, send the API request.

Here is the response to the Filestack OCR API request:

{

"document": {

"text_areas": [

{

"bounding_box": [

{

"x": 187,

"y": 170

},

{

"x": 293,

"y": 170

},

{

"x": 293,

"y": 226

},

{

"x": 187,

"y": 226

}

],

"lines": [

{

"bounding_box": [

{

"x": 188,

"y": 170

},

{

"x": 266,

"y": 171

},

{

"x": 266,

"y": 181

},

{

"x": 188,

"y": 181

}

],

"text": "Invoice to:",

"words": [

{

"bounding_box": [

{

"x": 188,

"y": 170

},

{

"x": 239,

"y": 171

},

{

"x": 239,

"y": 182

},

{

"x": 188,

"y": 181

}

],

"text": "Invoice"

},

{

"bounding_box": [

{

"x": 245,

"y": 171

},

{

"x": 259,

"y": 171

},

{

"x": 259,

"y": 181

},

{

"x": 245,

"y": 181

}

],

"text": "to:"

}

]

},

{

"bounding_box": [

{

"x": 187,

"y": 188

},

{

"x": 263,

"y": 188

},

{

"x": 263,

"y": 197

},

{

"x": 187,

"y": 198

}

],

"text": "Dwyane Clark",

}

Note: This is just a fraction of the response. You can see the full API response in Postman.

Best Practices and Considerations

- Clearly define your objectives for integrating an invoice OCR API and choose the OCR API accordingly.

- Create a standard invoice layout or format for enhanced data extraction accuracy.

- Automate the validation and verification of the extracted data

- Integrate the invoice OCR API with ERP or accounting software

- Create automatic approval workflows

- Ensure data security and privacy of sensitive financial data by implementing strict access controls

- Monitor the performance of the automated invoice processing system regularly and identify areas for improvement

Conclusion

Invoice processing is a crucial process in any business. It involves extracting data from various invoices and entering it into the computer. The data is then validated, verified, and sent for approval. However, manual invoice processing is time-consuming and labor-intensive. That’s why organizations worldwide are now automating invoice processing. One of the key technologies that has revolutionized invoice processing automation is OCR. It leverages machine learning to automate invoice data entry.

Sign up for Filestack today and automate your invoice processing with Filetsack OCR API!

FAQs

How does an Invoice OCR API improve invoice processing efficiency?

An invoice OCR API automates data extraction from invoices, eliminating manual data entry. It speeds up the processing time and minimizes errors. This allows for quicker invoice reconciliation and approval. This efficiency boost not only saves time but also resources. Hence, OCR invoice automation makes the entire invoicing process more streamlined and accurate. It also helps with efficient invoice management.

Can invoice OCR APIs be integrated with existing financial systems?

Yes, most invoice OCR APIs are designed for easy integration with existing financial systems and software. They typically offer flexible integration options. This allows businesses to incorporate OCR capabilities into their current invoicing workflows seamlessly. Thus enhancing their existing financial infrastructure with minimal disruption.

Are Invoice OCR APIs secure for handling sensitive financial data?

Security is a top priority for Invoice OCR APIs. Security is particularly essential when handling sensitive financial data. These APIs usually employ advanced security measures, such as data encryption and secure access protocols. This ensures that all invoice data is processed and stored securely, protecting it from unauthorized access or breaches.

Sidra is an experienced technical writer with a solid understanding of web development, APIs, AI, IoT, and related technologies. She is always eager to learn new skills and technologies.

Read More →